Deal Extension Risk

Summary

- Annualized Returns are significantly adversely effected by the extension of closing dates for mergers and acquisitions (extension risk).

- Acquirers tend to overstate expected completion times so as to reduce the likelihood (and embarrassment) of issuing extension updates.

- We analyse the completion times (both expected and observed) of cash deals, U.S. targets during 2016 and what effect changes to those completion times have on returns.

How Merger Arbitrage Works

Experienced arbitrageurs are well aware of how to calculate merger arbitrage returns and pair that return with its associated risk. In this case, the “risk” is the downside potential using the dynamic floor price should the deal fall through. This article assumes the reader is familiar with the basics of this complimentary event driven investment strategy. We do not cover identifying and calculating downside risk in this article. For additional information, we direct the reader to the many excellent academic texts previously written. This merger arbitrage book list also provides great background material. We find Kirchner’s book Merger Arbitrage: How to Profit from Global Event-Driven Arbitrage (Wiley Finance) of greatest use.

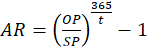

Along with risk analysis, being able to compare returns of one deal to another is equally important. Calculation of the simple spread is not sufficient. The trader needs to consider the length of time over which they will employ the capital. By annualizing the return, the investor arrives at a standardized comparative figure. Using the following formula (excluding interest rates) one can calculate the annualized figure

Where,

AR = Annualized Return %

OP = Offer Price made by acquiring company

SP = Stock Price or Initial Purchase Price

t = expected days to completion

A list of pending merger arbitrage deal spreads which form out T20 portfolio is available FREE and updated on a weekly basis.

Deal Completion Timelines

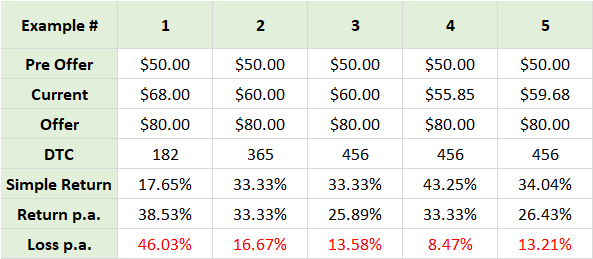

From Table 1 below, deal 1 takes 6 months to complete (182 days) and has a simple return of 17.65%. Example 2 has a spread of 33.33% and is expected to close in 12 months. The comparison can be made between 17.65% 6 month return for deal 1 versus 33.33% pa return for deal 2. Deal 2, which may have previously been ignored is now preferred to deal 1. However, an extension to the deal completion timeframe will cause a decline in the annualized return. In example 3, the details remain the same as example 2, but the expected closing date has been extended by 3 months. This causes the annualized return to fall to 25.89%. Accordingly, the annualized loss decreases because capital lost in the deal is done so at a slower rate.

In example 4, we retain the extended closing date but the price of the target stock has declined to $55.85. It now offers the same annualized return as in example 2. This adjustment in the market following the extension announcement assumes the probability of deal completion remains constant. This is despite any negativity surrounding the reason for the extension. This lowering of the target stock price also reduces the maximum loss altering the risk/reward ratio from example 2. In order to maintain this ratio the stock price would move to $59.68.

Stock Movement

The graph below shows how prices converge towards the offer prices of the original and extended deals. (This is a situation one devoid of market fluctuations and other price effecting actions). These lines do gently curve up towards the offer price as the daily % returns remain constant. The orange line (extended deal) starts at a lower value following the extension announcement. It subsequently recovers this loss over the (extended) duration of the deal

Analysis of Deal Extension Risk

Therefore, here lies the problem. What timescale should we use when annualizing the return without increasing deal extension risk? One source is to use the press release (contained with the 8-K filing with the SEC) at the time of the deal announcement. This gives an expected closing date as forecasted by the acquiring company and its advisors. However, is this date accurate? It is in the best interests of the acquirer to give a date that is not too distant. Management does not want the market questioning their effectiveness. Simultaneously, a date that allows some leeway should an unexpected delay materialize is also wise. This extended date reduces deal extension risk but also reduces the expected profitability of the trade.

The Effects of Deal Extension Risk on Profitability

The largest overstatement from our data sample was the takeover of ZELTIQ Aesthetics (ZLTQ) by Allergan Plc (AGN). This deal was completed in less than one quarter of its expected time and was reduced to the bare bones timescale of customary closing conditions such as regulatory filings, shareholder votes etc. The data set, which we analysed had an average expected completion time of 124 days but an observed completion time of 84 days. A one-third reduction. Choosing an acquisition with a spread of 2% with this 40-day time reduction increases the annual return by 2.90%.

Alternatively, the longer each deal completion takes, the fewer times that same capital is available for reinvestment in new opportunities. We have a list of the largest US Cash Merger Arbitrage spreads on this website. This has a large negative effect on annualized returns and can be extremely destructive to the return of a portfolio. Deals can drag on indefinitely only to have their original deal terms revised, such as Cabela’s (CAB). Worse still, abandoned such as Rite Aid (RAD). Another example of extension risk is the takeover of Alere (ALR) by Abbott Laboratories (ABT). Announced on Feb 2, 2016, the deal was originally expected to close 150 days later at the end of June. The deal finally closed on October 3, 2017 (610 days), a 307% extension.

Action

So how can an investor better gauge the expected closing time for a deal and use this to their advantage? Are there clues such as regulatory issues at the sector level within certain “protected” industries for instance finance or utilities (FCC)? Are there competition issues such as HSR requirements from the SEC and the DoJ that need to be considered? Are foreign takeovers a cause for concern once government level bureaucracy becomes involved? A 2015 paper entitled “Antecedents of Time to Completion in Mergers and Acquisitions” by Luypaert & Maeseneire, studies the effects of merger delays from the perspective of the merging entities. From this paper, one can determine the three most important factors all prospective arbitrageurs should be aware of:

- Deal complexity

- Deal hostility

- Shareholder support

Deal Extension Risk as a Usuable Strategy

One can use the expected closing date (as given by the acquirer) as a starting point. From there, the investor can begin to formulate an opinion of when the deal may close. The trick is to gauge how these factors already affect the initial acquirer expected closing date. Prediction methods depend on the resources at hand, the level of knowledge and time constraints (especially for the amateur investor). A multiple regression equation can identify a more accurate prediction of closure dates. The result is known as the forecast completion date. This is our preferred method and in doing so we have been able to more than halve the prediction error. This is when compared to the base case using the acquirer expected date. This heavily robust equation performs well during walk-forward analysis and is an indispensable tool in merger arbitrage valuation.

Alternatively, a simple rule of thumb calculation can be employed. Investors should be aware of the tendency for deals to close early and can subsequently make the reduction adjustments accordingly. Use a shorter expected deal time in the equation above and select a basket of deals based on the output. This reduction varies across industries but adjustments can be made using the criteria and variables discussed above. Mergers and acquisitions featuring elements highlighted by Luypaert & Maeseneire are strong candidates for examples of extension risk. Deal complexity involving industry regulators or CFIUS and have significant political risk are particularly susceptible.

Conclusion

Time consideration plays and important role in merger arbitrage deal selection. This article identifies some of the most important factors and offers suggestions as to how to utilize them to enhance portfolio performance. It has been demonstrated how time consideration effects can improve portfolio performance by recycling investment capital into new opportunities.

Finding this information useful? Here's what you can do to help...

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

- Sina Weibo

- Twitter etc.

- Follow us on twitter @MergeArbLimited.

- Become friends with us on Facebook

- Register for news alerts and merger arbitrage deal analysis postings via email using the sign up form.

- In addition to these, an RSS feed is also available at the bottom right of the page.

- Contact us using the details given on the Contact Us page.

- Donate using the paypal widget in the sidebar. It’s gladly appreciated and we need the coffee! See the Paypal section for additional incentives

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

Thanks for reading!