This is the Merger Arbitrage Spread Performance November 11, 2018 analysis. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 5th – 9th November. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 4th November.

Winners

This week’s star performer was KTWO gaining 2.92%. Following the formality of a shareholder vote in favor of the takevoer on November 7th the stock immediately jumped to the offer price of $27.50. The necessary documentation was filed Friday morning and the stock ceased trading. Last weeks 2nd best performer is again in the number two spot. RCII, up 1.83% (an almost identical increase to last week) announced better than forecast results on Monday beating analysts forecasts by $0.04 per share. This immediately sent the stock up almost 1%. In third place also showing a strong performance is NXTM 1.51% which was last weeks best performer. The stock continues to creep towards its offer price as completition of the deal becomes more certain. HIFR traded high above its offer price on broker reratings (strange, in light of the current takeover bid) and one unsubstantiated rumor of a large stake being amassed. At one stage the stock was more than 4% above its offer price (as observed in one of our tweets) but finished the week trading at a 1.25% premium. Solid gains throught the week were also recorded by RHT 0.88%, AVA 0.63% & DNB 0.46%.

Losers

Portfolio Performance

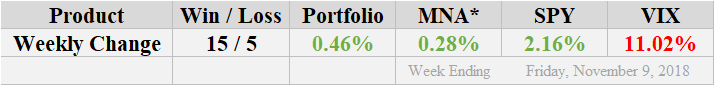

MNA SPY VIX Returns Table 20181109

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

And Finally…

The most recent list of the largest spreads is already available, and you can check out the rules for inclusion here. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.